2022 - Fintech fundraising trends - Recap

FT Partners and CBInsights recently posted their 2022 summary around Fintech deals/financings. Key factor to consider here in looking at both the reports is that the numbers don’t necessarily match(each of them probably classifies firms differently. FT Partners in my opinion is a bit more comprehensive as well) but that doesn’t take away from the fact that each of the reports is super insightful and broadly, the themes can be tied together which is what I have tried to do here.

Before looking at the trends of 2022, its important to look at the policies and what was happening across the world post the GFC(Great Financial Crisis) -

The 2008 crisis saw 3 main things emerge that laid the foundation for the next decade

The ZIRP(Zero interest rate policy) especially across U.S/EU Central Banks.

Quantitative Easing and asset purchases by Central Banks

Regulatory changes

Massive run up in equity valuations especially in the U.S markets. 2010s saw the U.S market outperform the Emerging markets.

Reason for run up in equity valuations can also be explained by what valuation is in its core essence. It is taking the expected cash flows in the future and discounting them back to the present. Discounting back is happening based on the discount rate. There is no such thing as a discount rate that everyone uses and is usually at the discretion of how someone making an investment might think of it. One way to potentially look at discount rate is to look at risk free rate(in U.S, this would be the interest one can make by investing in treasuries.). With rates almost at 0 and discounting back the cash flows with low rates means that the valuation of a company would be higher.

Low interest rates also had an after effect of people trying to determine potential investment opportunities where they could make higher returns. This was especially evident in the way pension funds were increasing their fund allocation to alternative assets(VC/PE/Real Estate etc).

With the onset of covid in early 2020, the world saw massive fiscal and monetary stimulus.

All combined, 2021(more details to follow in the post below) saw massive run up in equity valuations, money deployed via venture capital/private equity, and increase in asset prices(especially real estate) across the board.

Covid lockdowns had a massive impact on the supply side especially considering China shutdowns in 2021.

These trends were pretty much universal across most of the countries.

2022 finally saw the confluence of 3 main things.

High inflation

Russia-Ukraine war

Rate hikes(almost all the Central Banks engaged in this)

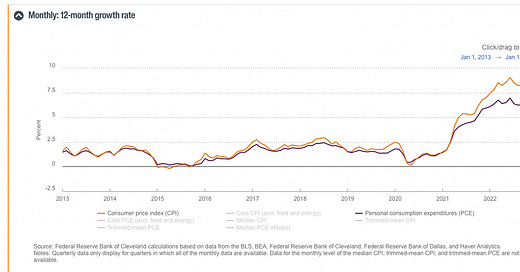

Beginning with inflation in U.S, post 2008 Great Financial crisis and onwards, inflation usually hovered under or slightly over the 2% mandate that the Federal Reserve usually targets.

Confluence of factors ranging from supply side shocks given Covid closures, fiscal relief during covid, zero interest policy, and finally the Russia-Ukraine war led to inflation climbing up to a peak of 9.1% in 2022.

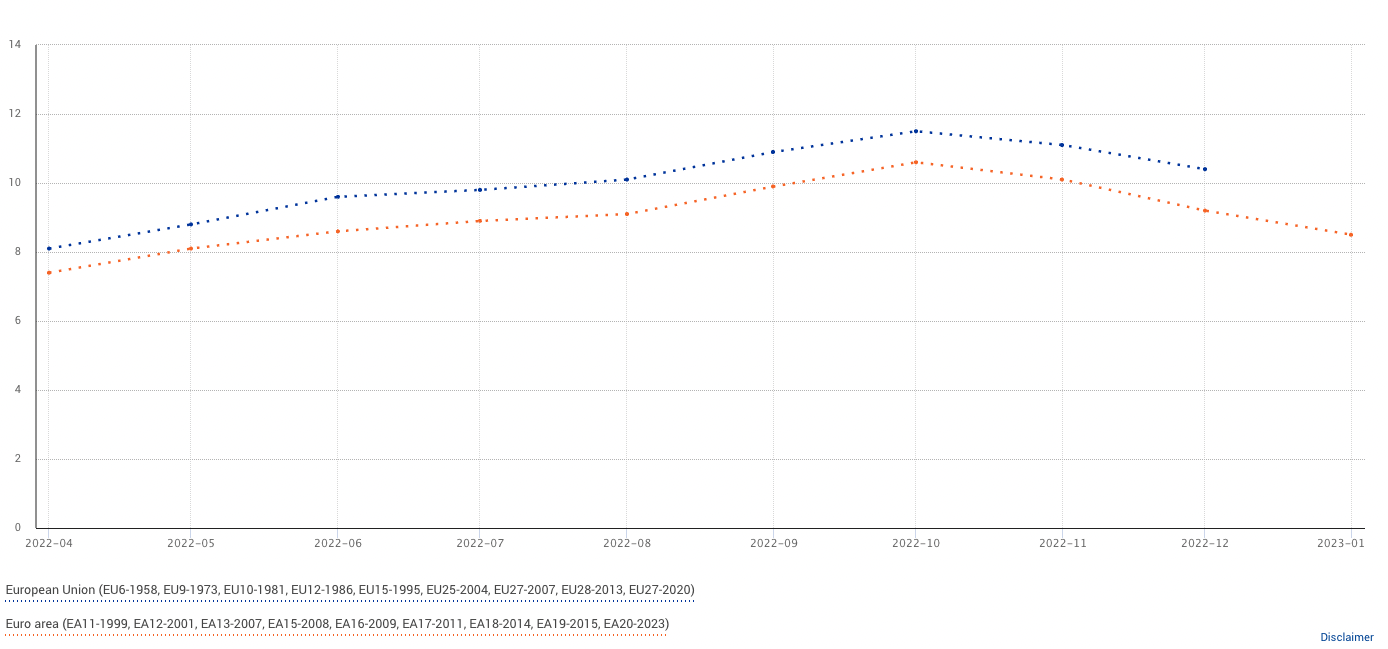

The same trend played out in the European Union where inflation in aggregated topped out at ~11%

Given the inflationary pressures, Federal Reserve in U.S proceeded to kickstart the rate hikes and took the rates from .25% to 4.50%

Almost all the G20 countries(with notable exception of China given the covid zero and economic issues they have been facing) have proceeded to raise rates in 2022.

So what happened in 2022?

In having laid the foundations broadly on how we , we can finally look at the numbers that FT Partners and CB Insights put together.

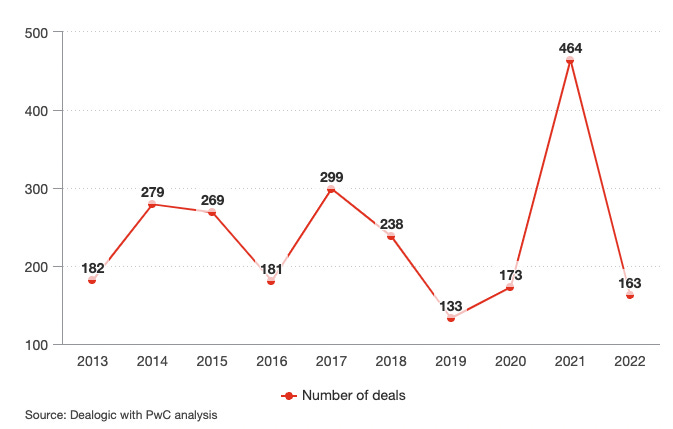

2022 saw value of all deals(IPO, private financing, M&A) fall to $217.7B which was a ~58% reduction compared to 2021.

One thing to highlight and I suppose this is not fairly well understood but 2021 fundraising environment was truly an anomaly. The easy monetary and fiscal policies, and investors crowding in on investment trades around private sector led to a markedly increase in valuations accorded to these companies. If we look at the talking points across most of the VC’s, the conversation switched to ensuring growth at all costs.

The coming back to Earth moment for 2022 means that the total volume of all deals is back on levels with 2018/2019 numbers. If we ignore the Q1,22 numbers(when the war and rate hikes impact only came about in the last month of the quarter) and take the average of Q3/Q4 and extrapolate that volume across the year, 2022 volumes are ~$160B which would be about 30% of 2021 volumes.

Drying up of the IPO market

Before looking at how Fintech’s did, it’s critical to look at the impact on the IPO volume across the U.S, E.U, and A.P.A.C.

U.S and Europe saw massive drops in the number of IPOs in 2022 and reverted to being slightly lower than the 2018/2019 numbers.

The APAC region saw a slowdown as well but the reason for the resiliency lay in IPOs happening in China, South Korea and India. China saw the highest number of IPOs over the past 10 years and the $ volume raised was elevated because of China National Offshore Oil Corporation and China Mobile listing on the Shanghai stock exchange after getting delisted on NYSE in 2021.

South Korea and India also saw resiliency in their markets and saw companies raise ~$13B and ~$8B in 2022.

How did the Fintech companies fare in this downturn across all the regions? AMTD Digital was the only Fintech company to go public(raised $125M) in 2022. Over the past 12 years, this is the lowest when it comes to number of companies going public and total amount raised as well.

Companies choosing not to go public amidst the chaos of inflationary pressures, market mayhem, and rising rates is not surprising. Though, how long can this stick is the question to ponder upon. There are 3 potential ways for a company to provide liquidity to its investors/employees

IPO/SPAC

M&A

Private fundraising

Technically, IPO + M&A are the only liquidity release mechanisms. The reason why I have included private fundraising in here is because

Companies have found it easy to continue raising in the private markets

Deepening of financing available

VCs getting comfortable with companies staying private

The reason why I am highlighting this is given the strategy that is being pursued by companies that choose to stay private. Some that especially come to mind are Stripe/Klarna/Checkout/Chime. All 4 companies have crossed 10+ years of being private and pursuing fundraising by predominantly tapping the growth funds. There are several consequences to this strategy of staying away from public markets/supposedly short term thinking/getting on the route of profitability after focus on growth only. Tax implications for shares held by employees, lack of liquidation options for employees unless the firm is providing that option during its fundraising(even that is usually restricted), employee retention and happiness, and potentially harder to acquire companies without having the public capital.

Now, I don’t really envision 2023 with all the uncertainty to be the year where we will see a flood of companies potentially start to think about IPOs but there is an absolutely large cohort of Fintech’s from the 2010s decade that exists as private companies. This is a speculation but if inflation stays at slightly elevated levels and Central Banks don’t necessarily push the world back to easy monetary policy(unless there is some drastic change in the economic scenarios), I find it hard to imagine the strategy of staying private/raising large amount of funds to be the viable way to go. In all honesty, over the next 2-3 years I am actually excited to see if we have a directional change from these companies and we see a large number of Fintech’s start going public. Not only does this lead the industry towards a more mature stage, it provides capital to a large number of employees if needed to start funding/building ecosystems regionally.

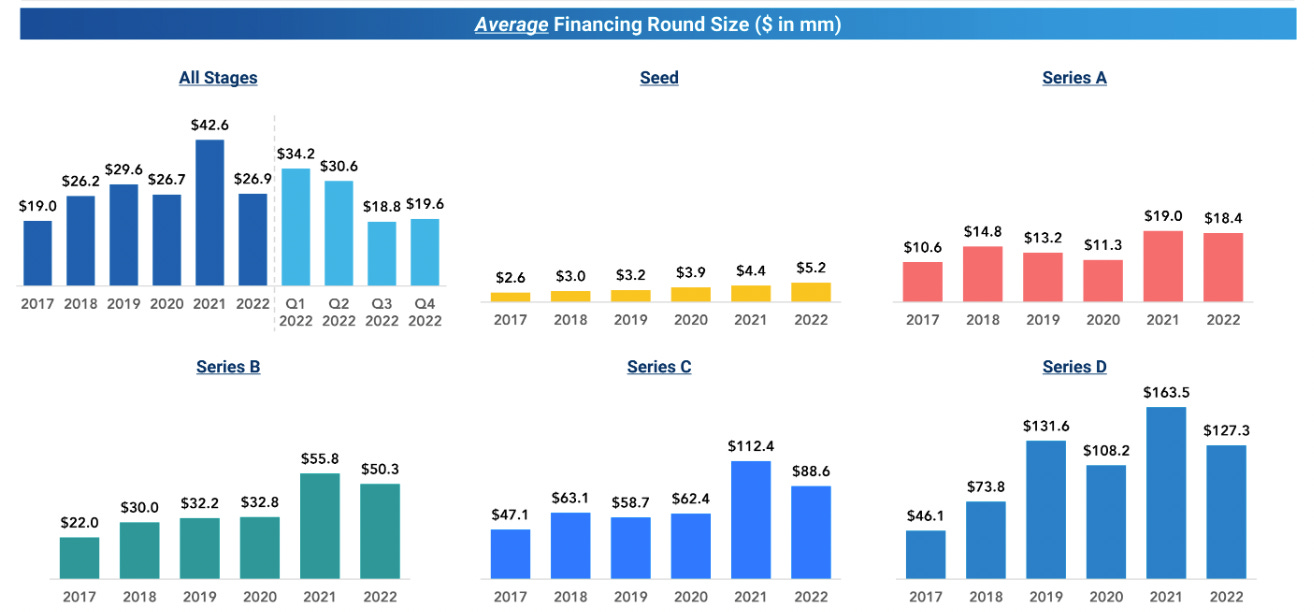

What happened to the deal size?

A major surprise for me in looking at the FT Partners data was in how badly affected was $100M+ sized deals. Even though the quarter breakdowns for 2015-2019 timeframe is not available, seeing only 25 financings that were greater than $100M in Q4-22 is probably in line with QoQ comparisons from those years. The key difference though is that we are comparing a time period from now where

The scale of operations are far larger than from the first of the 2010s decade

Markets being targeted are massive

Companies that are staying private for far longer and probably have a need for capital

Fintech ecosystem has grown a lot across multiple regions and is fairly well developed compared to the early years almost a decade ago

Another trend that was highlighted by several VCs based on their observation and seen through the data is the focus switching back to seed/series A rounds, deals still being priced evenly for those stages, and the reset in valuations that are being seen across the board for anything around the growth stages. This is exactly what FT Partners is seeing in the 2022 aggregate data across all regions.

Europe is a massive surprise if we look at the median deal size given that if compared to U.S there is far more similarity in the ecosystem, link between capital markets, and cross pollination of firms targeting these markets.

It might still be far too early and the markets are probably a bit too fragmented but Africa still presents a massive opportunity and I suppose that enthusiasm is carrying over in the deals that VCs/Strategic buyers are seeing/participating in.

VC and Corporate Venture Capital trends

Seeing Tiger Global at the top of the list of investors doesnt surprise me but this was very much front loaded for the first half of 2022. Someone I am surprised that doesnt show up on this list is Coatue.

Given the craziness and money flowing into the crypto world, it’s not one bit surprising to see that 6 out of the top 10 CVC firms are related to crypto. Fairly certain that the 2023 list will not look anything like this. If anything and done strategically, we might see the venture arms of banks become aggressive whether it is in making investments or working with their corp dev teams to acquire firms.

I wrote the following on banks and my optimism around the advantages they possess in this post

I am a bit conflicted on this and obviously with the benefit of hindsight, it seemed bold to believe that disruption of traditional banking players was a guarantee. I am always reminded of the seminal post by Alex Rampell almost 7 years ago where he said the following - “The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.”

Banks have 2 advantages that stand out -

1. They are the medium through which Central Banks are able to run monetary policy and in most of the countries this is a very critical feature of the system.

2. To be able to do so, they have very much surrendered to rigorous compliance process. What have the banks gotten in place of this? Regulatory licenses that help differentiate them from non bank financial institutions and restrict lending activities to such firms.

I don’t mean to turn this into a banking primer but these advantages are probably here to stay. Well run banks flush with profits are starting to understand the competitive threats posed by fintechs and investing heavily in their tech operations, products they offer to customers and are finally finding that innovative streak to catch up to the competition.

The reasons for highlighting this again is that as we see in the image below, CVC investments have been increasing steadily over the past year. I believe that banks and other incumbents have come to slowly realise the threat that the new entrants pose and thus see an increased focus from an investments/ acquisition perspective.

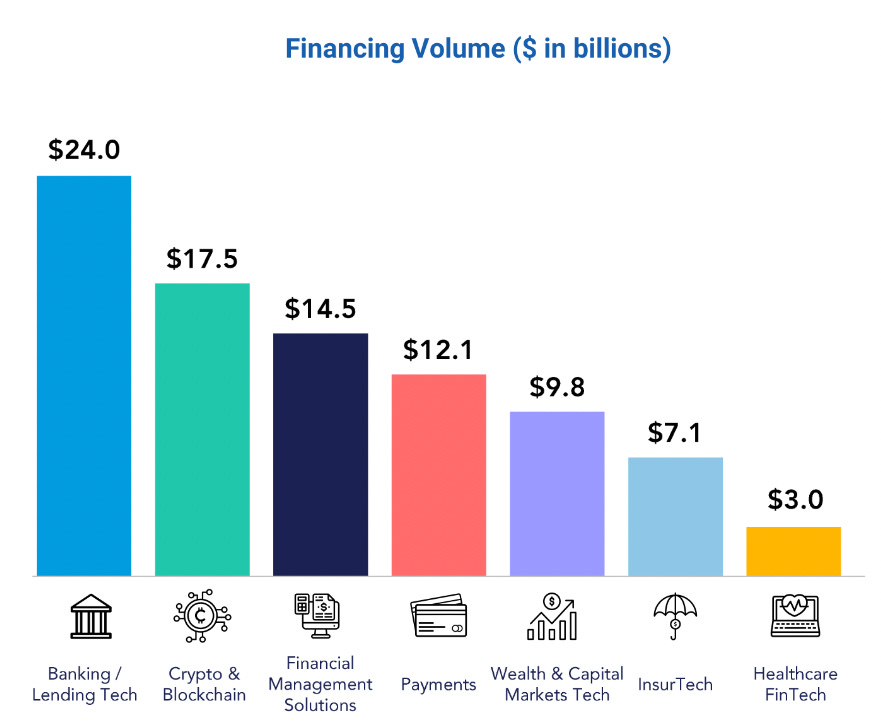

Breakdown by Sectors

This is the point where given my lack of understanding of some of these sectors, I feel it’s much better to let the numbers do the talking.

Amidst all the chaos of last year, the following companies(see image below) were able to successfully raise additional funds and ended up becoming unicorns. I think it was only fitting to end this post by highlighting a few of these companies that I know about and have come to admire a lot.

Jeeves

They really embody what A16Z has highlighted as having a global first attitude. The firm can be broadly classified within the corporate spend and expense management business though that is where most of the similarities end.

In keeping the international focus on top of the mind, the two things that the company does is around providing credit cards and working capital loans.

In looking at their 2022 in review, the firm highlighted the following

We launched some new products this year, including:

Jeeves Growth Capital: Helping companies get funding based on their revenue.

Jeeves Working Capital: A revolving line of credit on 30, 60 or 90 day terms that is founder friendly.

Jeeves Pay: The only cross-border payment method that allows companies to make international payments that are credit-backed.

Up until last year, the focus from an expansion perspective was U.S + LatAm but it seems like that the firm has also started expanding across European markets.

Younited

It’s a French based lending firm that operates out of France, Germany, Italy, Spain, and Portugal.

The product suite revolves around the following

Broadly, the firm can be classified under the BNPL model but for much larger ticket sizes. Younited credit product is decoupled from the merchant and available to consumer as a standalone product.

At the same time, merchants whether it’s the ones selling low ticket items or ones that scale up to products that cost thousands can embed the product and offer lending solutions to their customer.

Qonto

They are a French fintech that are primarily focussed on providing neobanking services to SMBs

What they currently offer to business can be broadly broken down into the following 4 categories

The focus for the firm so far has been in providing banking services to businesses across Western Europe(France, Germany, Spain, and Italy). One key thing to understand about Europe is that interchange is either capped or unregulated but with lower rates than U.S. This plays into the business models for both consumer and business neobanks.

There are 220,000 companies paying for Qonto every month. Pricing ranges from €9 per month for the most basic freelancer account to €249 per month for enterprise accounts. On top of that, some companies pay more to get more cards or when they go above certain limits.

Unit

They are a Banking as a Service provider that provides services in U.S.A(Personally, I have absolutely loved the blog posts that come out of the Unit team hence the bias in highlighting them here :) ).

The following comes from their last fundraising announcement

Since launch, we’ve grown to serve 140+ customers, from public companies to early-stage startups. The list includes AngelList, Invoice2Go, Homebase, HoneyBook, Roofstock, and many more. Our customers have been able to take advantage of our unique approach—a modern tech stack built on a native ledger, streamlined compliance, and built-in bank relationships—to launch in weeks.

In the last six months, we’ve seen deposits held at our bank partners grow 10x and cross $100 million. We’ve also seen banked end-customers grow 7x to over 350,000 and annualized transaction volumes grow 7x.

One can deep dive into almost all the features that the company offers but one thing that stood out is that their product offerings target both consumer and business banking. Broadly, it might seem that each of them have a lot of overlap fairly similar use cases but that is not really the case. Business banking has a lot of focus around specific use cases such as expense management, invoicing, reconciliations, spend allocation etc. These are use cases that do not necessarily stand high in the list of features needed for consumer banking providers.

Open

The firm is a leading SMB focussed neobank in India that raised close to $50M in its most recent fundraise in 2022. The product suite as seen below seems extensive but the core focus seems to around Current Account, Payments, Cards, and Accounting.

The firm boasts that 2.5M SMEs use their product but it’s not clear on how many of them are paying customers. Payments/interchange is not necessarily a massive revenue source in India like it is in U.S and other regions. The monetisation strategy really revolves around getting utilisation of product across multiple vectors, moving those customers to a paid product, and finally lending.

Finally, even though India has leapfrogged and progressing through the digital arena via the development of the India Stack over the past decade, it is reasonably well known that SMBs and their day to day operations/tracking/reconciliation are fairly manual. The legacy banks beyond their lending prowess have not necessarily tried to provide a comprehensive digital solution that helps with the end to end processes. I am looking forward to the work being done especially by the trifecta of Open, Razorpay, and Khatabook and seeing how it improves drastically the way SMBs go about their day to day operations.

Thank you for reading. Hope you enjoyed this post!